So you’re a medical professional who is preparing to purchase a property for your practice. What kind of finance will you need? How do you go about creating a strong business plan? And the property — that’s just one element. What about financing for the practice fit-out?

OK, stop. Take a breath. Relax. We’ve sourced two experts who can help allay your concerns: Senior Financial Advisor Abraham Aguilan and Expert Medical Finance Broker Ryan Manson, from boutique Sydney-based finance firm Infusion 360, work with medical professionals every day who are time-poor and struggling to manage their financial health. Below, Abraham and Ryan step us through the various planning stages they say are critical to the purchase of any medical property.

Big picture planning

Let’s start broad. When Abraham or Ryan first meet with a new client they begin with a goals-style consultation, gathering all the detail they can on what the client is looking to achieve when purchasing a medical property; or indeed pursue occupancy of any type of healthcare real estate.

Learning about the client’s area of medical specialty, their particular niche within this speciality, and where they are at in their career (e.g. if they are a new Fellow, someone who has been practising for 5 -10 years, or a more established doctor) comes first.

Discussion of how this information plays into the client’s business plans, both for now and into the future is what follows.

“We talk about a whole range of things,” Ryan explains.

“From the location of a property or site, through to the size of the space needed and the client’s timing requirements; for example, are they looking to buy now or in 12 months when they become a Fellow?” he says.

“Is the client looking to establish just one practice site or is there scope for the development of multiple practices?”

Such goal-driven discussions generally lead to a SWOT (Strength, Weakness, Opportunity and Threat) Analysis that incorporates investigation of a whole host of aspects involved in setting up a medical business, including real estate locations, competition from similar medical providers in the area, and the specific needs of patients living in and around the area.

Buy or lease? The cost-benefit analysis

While purchasing a medical property may initially seem like the most advantageous choice for your practice, the next important stage of planning is designed to investigate and compare the range of real estate options available to you, and ultimately find the one that’s going to be the right choice.

Here Abraham and Ryan take clients through a detailed cost-benefit analysis that compares everything from setting up a small-scale (single doctor) practice to a large scale, multi-specialty practice. They discuss the range of real estate options, from renting a single suite in an established practice, to renting a full practice, and purchasing a permanent location.

“If a doctor is young and hasn’t been practising for too long, their asset position may not be as strong as that of a more established medical professional,” Abraham says.

“Renting a suite in an established practice or health hub may prove to be the smartest option in the short-term,” he explains.

“Having said this, if a doctor is in a financial position that allows them to cover the initial financial responsibilities of purchasing a permanent practice location or commercial property, this may be more cost-effective than renting over the long-term.”

A client’s business goals — identified in the first stage of planning — are now considered against his or her current financial position, along with their business’ growth forecast and projections.

“The cost-benefit analysis provides the client with a detailed summary of the proposed strategy to help them gain confidence as they embark on this journey,” Abraham says.

Building a robust plan

Right. You have identified your business goals and undertaken a thorough cost-benefit analysis of the range of real estate options available (both rent and purchase).

Now it is time to build a robust business plan for your practice.

According to Abraham and Ryan, just as the cost-benefit analysis did, this stage of the planning process leans heavily on research.

Investigating set up costs (including furniture, high-tech medical equipment, IT requirements etc.), ongoing expenses such as staffing (external or internal practice management), cleaning, maintenance and medical consumables, and taking a realistic look at how quickly your practice will begin to generate income and then continue to grow it, is the kind of research we’re talking about here.

“We are assessing the business as a whole and working through a detailed projection plan that will forecast the practice’s outgoings and income — usually for a 3-5 year period,” Ryan explains.

“Once the doctor has the detailed projections and business plan they will able to manage their expectations and feel comfortable that the practice will generate sufficient revenue to justify the planned strategy and purchase,” he says.

Types of finance

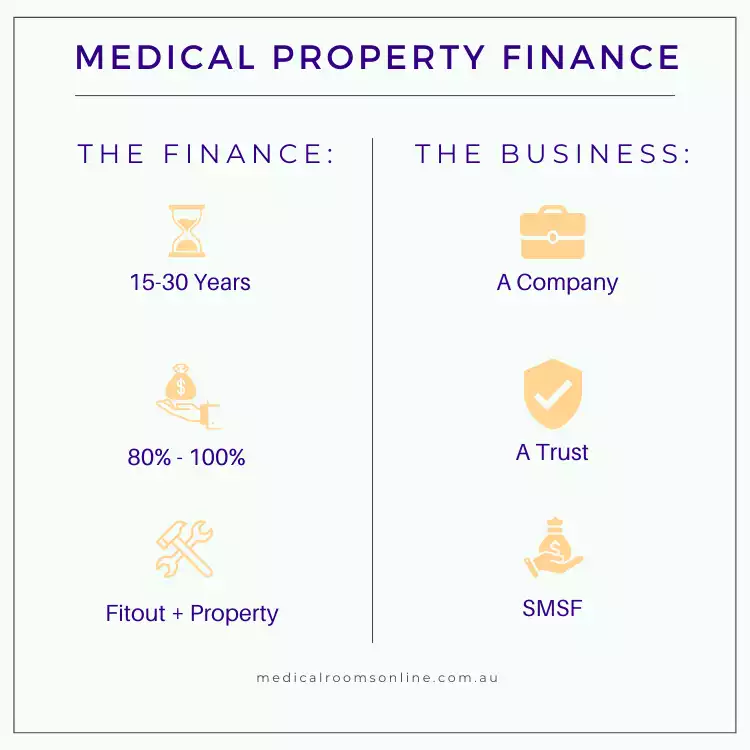

A medical finance facility can be taken out to purchase the medical practice and associated fit-out and ongoing costs.

Commercial property can be taken out in the form of a 15-30 year loan term and with interest only periods of up to 10 years are generally available for medical professionals with a healthy income and strong projected earnings.

A medical professional who is planning to practise in the property being purchased will generally have the option of borrowing up to 100 per cent of the purchase price, while an investor who will not be working in the practice usually has the option to borrow up to 80 per cent of the purchase.

In some cases the cost of a practice’s fit-out and purchase of medical equipment can be set up as a separate loan, in addition to the practice purchase.

Deciding on your business entity’s structure is critical to this stage of planning.

Abraham and Ryan explain that the three most common structures medical professionals will consider here are company, trust or self-managed superannuation fund.

Business structures

Company. A company is a legal entity that is separate from its owners (i.e. shareholders). If you run your practice through a company structure it can limit liability for the owners and provide flexibility for business growth. As a company, you could have access to reduced tax rates (a company tax rate is generally lower than an individual’s tax rate). If you are planning on establishing a business with other partners this could be the most suitable option for you.

Trusts – unit trust or discretionary trust. A trust is a legal structure that allows you to manage property or a business for someone else’s benefit and can be an excellent way to optimise tax and protect your assets. Generally, there are two types of trusts – a unit trust where the entitlement to the assets and/or income is defined or fixed, and a discretionary trust where you can choose who can benefit from the trust and how much money or entitlements beneficiaries can receive.

Self-managed superannuation fund. A popular vehicle for owning property is through a Self-Managed Super Fund (SMSF). As your superannuation savings are preserved for retirement, a SMSF allows you to take control of how you use these savings and potentially use your superannuation to purchase your practice’s premises. The SMSF is a strong long-term option and comes with significant tax benefits over the long-term.

Other finance considerations

“Timeframes are an important consideration when it comes to finance,” Abraham says.

“The loan structure will be heavily dependent on how long the client wants to hold the practice, as well as their growth plans. For example, do they want other doctors to come into the practice in time,” he explains.

“We need to think about succession planning as well. There are lots of moving parts to consider.”

There are a number of other issues around finance to consider during this stage of the process, including stamp duty, capital gains tax, income tax, income distribution and asset protection.

Ryan says adequate business forecasting and projections are key.

“This is why things like projected patient numbers, establishing the average cost of a patient consultation and determining things like how many hours a doctor will need to work to make a loan’s repayments and be profitable are so important,” he says.

“At every point in the process we are assessing the business and being mindful of making decisions on the basis of these markers.”

Are you ready to purchase?

Browse Medical Rooms Online’s sales listings or contact our agents for their current properties to buy or invest in.